How to Invest Your Money Wisely and Grow Your Wealth

Investing your money can be a great way to achieve your financial goals and build your wealth. However, investing can also be risky and complicated, especially if you are not familiar with the basics of investing. In this article, we will explain some of the key concepts and principles of investing, and provide some tips and resources to help you get started.

What is Investing?

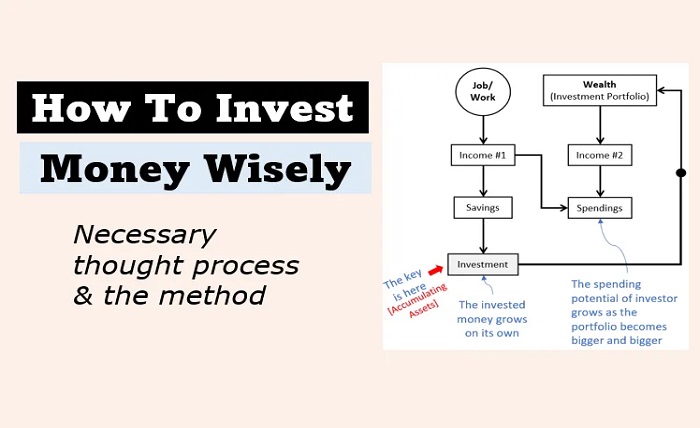

Investing is the process of putting your money into assets that have the potential to increase in value over time. These assets can be stocks, bonds, mutual funds, real estate, gold, cryptocurrencies, or any other type of investment that suits your risk appetite and time horizon. The main goal of investing is to earn a return on your money, either through capital appreciation (the increase in the value of your assets) or income (the dividends, interest, or rent that your assets generate).

Read more Invest Fest 2023: The Ultimate Festival for Investors and Entrepreneurs

Why Should You Invest?

Investing your money can have many benefits, such as:

- Growing your wealth: Investing can help you grow your wealth faster than saving alone, as you can benefit from the power of compounding. Compounding is the process of earning interest on your interest, which can exponentially increase your returns over time.

- Beating inflation: Inflation is the general rise in the prices of goods and services over time, which reduces the purchasing power of your money. Investing can help you beat inflation by earning a higher return than the inflation rate.

- Achieving your financial goals: Investing can help you achieve your short-term and long-term financial goals, such as buying a house, saving for retirement, or funding your children’s education.

- Diversifying your income: Investing can help you diversify your income sources, which can reduce your reliance on a single source of income and provide you with more financial security and flexibility.

How to Start Investing?

Before you start investing, you should consider the following steps:

- Set your financial goals: You should have a clear idea of why you want to invest, how much money you need to achieve your goals, and when you need it. This will help you determine how much you can afford to invest, how long you can invest for, and how much risk you can tolerate.

- Build an emergency fund: You should have some money set aside in a savings account or a liquid investment that you can access easily in case of an emergency. This will prevent you from having to sell your investments at a loss or borrow money at a high interest rate when you face an unexpected expense or income loss.

- Pay off high-interest debt: You should pay off any high-interest debt that you have, such as credit cards or personal loans, before you start investing. This will free up more money for investing and reduce the amount of interest that you pay.

- Choose an investment platform: You should choose an investment platform that suits your needs and preferences. There are many options available, such as online brokers, robo-advisors, banks, or financial advisors. You should compare the fees, features, services, and reputation of different platforms before making a decision.

- Choose an investment strategy: You should choose an investment strategy that aligns with your goals, risk tolerance, and time horizon. There are many strategies available, such as passive investing (buying and holding a diversified portfolio of low-cost index funds or exchange-traded funds), active investing (buying and selling individual stocks or bonds based on market analysis or research), or alternative investing (investing in non-traditional assets such as real estate, commodities, or private equity). You should research the pros and cons of different strategies before making a decision.

- Choose an asset allocation: You should choose an asset allocation that reflects how much of your portfolio you want to invest in different asset classes, such as stocks, bonds, cash, or others. Your asset allocation should match your risk tolerance and time horizon. Generally speaking, the more risk you are willing to take and the longer you can invest for, the more you should invest in stocks. The less risk you are willing to take and the shorter you can invest for, the more you should invest in bonds or cash.

- Choose specific investments: You should choose specific investments that fit within your asset allocation and investment strategy. You should diversify your portfolio across different sectors, industries, countries, and companies to reduce your exposure to any single source of risk. You should also consider the costs, performance, liquidity, volatility, and tax implications of different investments before making a decision.

How to Manage Your Investments?

After you start investing, you should monitor and manage your investments regularly. Some of the things that you should do are:

- Review your portfolio: You should review your portfolio periodically to see how it is performing and whether it is still aligned with your goals, risk tolerance, and time horizon. You should also check if there are any changes in the market conditions or in your personal circumstances that may affect your investments.

- Rebalance your portfolio: You should rebalance your portfolio periodically to maintain your desired asset allocation. Rebalancing involves selling some of the assets that have increased in value and buying some of the assets that have decreased in value. This will help you reduce your risk and lock in your gains.

- Adjust your portfolio: You should adjust your portfolio periodically to reflect any changes in your goals, risk tolerance, or time horizon. You may need to increase or decrease your exposure to certain asset classes, sectors, or regions depending on your changing needs and preferences.

- Learn and improve: You should learn from your investing experience and improve your knowledge and skills. You should keep track of your investment decisions and outcomes, and analyze what worked and what didn’t. You should also read books, articles, blogs, podcasts, or videos about investing and learn from other investors.

Conclusion

Investing your money can be a rewarding and enjoyable activity that can help you achieve your financial goals and grow your wealth. However, investing can also be challenging and risky, especially if you are not familiar with the basics of investing. Therefore, you should follow the steps and tips outlined in this article to start investing wisely and confidently. Remember, investing is a journey, not a destination. You should always be willing to learn, adapt, and improve as you go along. Happy investing!